Research Article :

The

importance of the stock market in the development of the economy of a country

can be directly linked to the governance, appropriate and effective regulatory

framework designed by the policymakers. Stock market plays a very significant

role in promoting capital formation and sustaining the economic growth of a

country. It efficiently allocates scarce resources which are used to finance

different sort of projects, leading to the prosperity and growth of the

economy. Moreover, it also serves as a vehicle for risk diversification

associated with projects, which helps to minimize the uncertainty regarding

investment returns. Olweny and Kimani (2011) have argued that stock market

facilitates the investment of surplus funds into additional financial instruments

that better match their liquidity preference and risk appetite. According

to Nordin & Nordin (2016), at the end of 2010 the Malaysian stock market

capitalization and debt outstanding stood at 165% and 97% of nominal GDP

respectively. This figures show that the Malaysian capital market is quite big

relatively to the Malaysian economy. Therefore, taking into account the size of

the Malaysian capital market, it is possible that this market could

significantly contribute to the economic growth of the country. In

this new era of globalization, the unpredictability of the stock market returns

has become a major subject in developing countries like Malaysia. According to

Lim & Sek (2013) high stock market volatility leads to a huge variation of

returns, and thus greater risk. Hence, having a good understanding of the

factors that affect the volatility of the stock market leads investors to a

more precise prediction of the stock price movements, which in turn reduces the

risk of making losses. Among

macroeconomists and finance theorists there is a mutual consensus that stock

market performance is driven by different macroeconomic factors. Although

several studies have been conducted in developed economies such as USA, UK and

German regarding the relationship between macroeconomic variables and stock

market performance, the nature of such relationship might be different for an

economy like Malaysia which is still under development. Therefor the

purpose of the current paper is to investigate the impact of exchange rate and

inflation on Malaysian stock market performance.

According

to Kutty (2010), exploring the relationship between macroeconomic variables and

stock market performance is of extreme importance to policymakers, economists,

and investors. Understanding this relationship helps them to better access the

efficiency of the market during portfolio management, given that the key risks

they face in the stock market might be traced back to changes in the

macroeconomic variables. Literature

Review

In

the past decades, several studies have been carried out into the relationship

between stock market performance and macroeconomic variables. However, Barakat

et al. (2016) argued that there is a need to a more in depth investigation of

the nature of this relationship, since some macroeconomic variables could vary

from one market to another as well as from one period to another. This section

provides a review of previous studies conducted by different authors on the

relationship between macroeconomic variables and stock market performance. Exchange

Rate

The

relationship between the exchange rate and stock market performance has been a

subject of study by many researchers. Exchange rate and stock market are both

considered as crucial elements in influencing the economic development of many

countries. Though, the findings regarding their relationship appear to be

inconclusive. Kutty

(2010) stated that movements of the exchange rate can have a huge impact on the

cash flows of multinational companies, since the performance of these companies

not only depend on the resources that companies possess, but also on the

fluctuations of the currencies, assuming there will always be a conversion from

one currency to another. Cakan

& Ejara (2013) studied the relationship between the exchange rate and stock

prices of twelve emerging market countries from May 1994 to April 2010 using

linear and non-linear Granger causality tests. They found that when the local

currency of a country depreciates, it makes exporting goods much cheaper and

this can lead to a rise in foreign demand and sales, and thus a rise in the

stock price. On the other hand, when the local currency appreciates foreign

demand of an exporting firms products shrinks; consequently the profit will

decrease as well as its stock price. Agrawal

et al. (2010) conducted a study on the relationship between the Nifty returns

and India rupee-US Dollar exchange rate using daily closing index from October

2007, to March 2009. Findings revealed a negative relationship between the Nifty

returns and exchange rate during the period analyzed. Similarly, Najaf &

Najaf (2016) used Granger causality test to check the level causal relationship

between the two variables in the Indian stock market. The purpose of the study

was to prove whether or not exchange rate is a crucial determinant of firms

profitability. Results showed that movements in the exchange rates negatively

affect the stock prices.

Younas

et al. (2013) also found a negative relationship between exchange rate and

stock price in his study in the impact of exchange rate on stock market in

Pakistan. This study revealed that exchange rate not only affects the returns

of multinational companies, but also affect the returns of domestic firms. From

multinational companies perspective, exchange rate brings a sudden change in

worth of its foreign operations which may reduce profitability and affect the

stock price negatively. While in the case of import oriented domestic firms,

stock prices will negatively be influenced due to the currency depreciation

which leads to an increase in the price of inputs which results in a decrease

in the profitability of the firms.

Milambo

et al. (2013) used the GARCH model to establish the relationship between

exchange rate volatility and South African stock market. Findings suggested

that movements of the currency have a huge influence on the value of the rand

of cash flows from foreign projects. However, the study also revealed weak

correlation between the volatility of the currency and the stock market, but a

huge impact in the financial system. In addition, it was found that the South

African stock market is affected by other macroeconomics variables such as

total mining production, interest rates, money supply, and the United States

interest rates.

Inflation

Rate

Inflation

is undoubtedly one of the most important macroeconomic variables believed to be

related to stock prices, and in turn also affected by it (Gupta and

Inglesi-Lotz, 2012). The literature regarding the relationship between these

two variables is not from today. Fisher (1930) suggested that there is a

positive relationship between stock market returns and expected inflation and

changes in the expected inflation. Whereas, Fama (1970) claimed that stock

returns and inflation are negatively related, due to the positive relationship

between real output and stock market returns and the inverse relationship

between real output and inflation. Adusel

(2014) investigated the relationship between the inflation and stock market

returns from Ghana Stock Exchange for the period of January 1992 to December

2010. The study found that there is a negative statistical significant

relationship between inflation and stock market returns in the short run.

However, this negative relationship becomes significantly positive in the long

run. The negative short-run between the inflation and stock market returns

suggests that a rise in the inflation will cause a drop in the price of stock

market. Mousa

et al. (2012) used time series data from the Consumer Price Index (CPI) as a

measure of inflation and the stock prices of ten selected companies in Jordan

as a measure of stock validation to test whether there is a correlation between

stock prices and inflation. Findings from the study suggest that majority of

the companies examined (70%) are negatively correlated against inflation,

whereas the rest (30%) show a slightly positive relationship between changes in

the stock prices and inflation. Moreover, results show that stocks cannot be

used as a perfect hedge to the degree that firms cash flow are negatively

correlated to inflation, and the relationship between stock price and inflation

can be either negative or positive. Wongbampo

& Sharma (2002) examined the relationship between stock market prices and

macroeconomic variables including inflation in five Southeast Asian countries

including Malaysia using CPI as proxy variable for inflation. This study found

a negative relationship between stock prices and inflation in all of the five

Southeast Asian countries investigated. Geetha

et al. (2011) analyzed the impact of inflation on stock market of three

countries namely: Malaysia, United States and China. The researchers used

secondary data consisting of monthly time series data from January 2000 to

November 2009. They also used interest rate, inflation (CPI), exchange rate,

GDP, and share prices of the three countries as variables of the study. The

study found that there is long run correlation between inflation either

expected or unexpected with stock returns, but there is no short run

correlation between these variables for Malaysia and US, but it exists for

China.

Uwubanmwen

& Eghosa (2015) conducted a research in the “impact that inflation rate have on stock

returns in the Nigeria stock market. The study also aimed to determine whether

stock returns in Nigerian stock market were influenced by the inflation rate

and also to establish whether stock returns in the Nigerian stock market can

effectively be forecasted using stock prices. Findings indicated that there is

a negative but weak influence of inflation on stock returns.

Ahmed

et al. (2016) used Johansen test to investigate the association between

inflation and stock returns in Bangladesh. The study used stock return data

from monthly closing stock price indices of Dhaka Stock Exchange (DSE), and

monthly data of inflation rate for the period of November 2004 to July 2013.

The Johansen test procedure established the existence of a single cointegration

equation at 5 percent significance level, which suggests a long run equilibrium

correlation between the stock market and inflation. The study also found a

short run positive relationship between the stock market and inflation in

Bangladesh.

To

summarize, it is observable from the literatures reviewed above that studies regarding

the relationship between macroeconomic variables (exchange rate and inflation)

and stock market performance has produced mixed results. Some studies found a

positive relationship between macroeconomic variables and stock market

performance, others found a negative relationship, and others no relationship

at all. These mixed findings result from the fact that each stock market has

got its own characteristics such regulations, economic development, investment

environment, type of investors and other factors. Methodology

The

research consists of monthly time series data collected from the period of

January 2007 to December 2016. This is basically 120 observations for each

variable obtained from Thomson Datastream. In line with previous studies, all

the time series data was transformed into logarithm form. Research

Variables

This

research aims to shed light into the relationship between the stock market

performance and two selected macroeconomic variables. The macroeconomic

variables analyzed include Ringgit Malaysia/USD exchange rate as proxy for

exchange rate and CPI as proxy for inflation rate. The Kuala Lumpur Composite

Index (KLCI) is used as proxy to measure Malaysia stock market performance.

According to Chong and Puah (2009), Kuala Lumpur Stock Exchange Composite Index

(KLCI) is a capitalization weighted index which is used as an accurate

indicator to measure the Malaysian stock market performance. Research

Strategy

This

research adopted quantitative design method to conduct the study. Quantitative

design approach uses quantitative data, which is any data in numerical or

mathematical form such as percentage, index, and descriptive statistics which

enables the researcher to do the hypothesis testing, measure and analyze the

data in arithmetical form. The

research also carried out several econometric tests in order to determine the

relationship between the stock market performance in Malaysia and macroeconomic

variables. The tests conducted include unit root test which consists of

Augmented Dickey Fuller (ADF) and Phillip-Perron (PP); heteroskedasticity;

model specification, granger causality, as well as multiple regression tests. Unit Root Test: In stock market,

empirical research is based on time series data. A pre-requisite for designing

meaningful results in time series analysis is to have stationary data in order to

enhance the accuracy and reliability of the models constructed. If the time

series data is non-stationary, regression parameters cannot be carried out, or

if they are carried out the results may not be accurate. A time series data is

considered as stationary if its mean and variance are constant over a given

period of time, and covariance are constant for a given lag. The stronger is

the stationary of the data; the best is for the research because it does not

lead to spurious regression. One of the most common ways to test the

stationarity of the data is using the unit root test. Although there are

several unit root tests to check stationarity of the data, this paper is using

ADF and PP tests.

Heteroskedasticity Test:

A

time series regression should consist of same variance of distribution.

Therefore, if the variance of distribution is not the same, it violates the

assumptions that the variances of the error terms are constant, giving rise to

heteroskedasticity problem. Heteroskedasticity can be caused by different

factors such as missing an explanatory variable or the variables are not

normally distributed. White (1980) argued that heteroskedasticity affects the

efficiency of estimated parameter and covariance matrix, misleading the results

of the hypotheses testing. Furthermore, Long & Laurie (1998) argued that

heteroskedasticity problem in time series data tend to underestimate the

variances and standard errors, leading results of both t statistics and

F-statistic to be unreliable.

Model Specification Test: Model specification is correct when the

relevant independent variables are chosen and included in the model, and when

appropriate functional form of variable into the model is selected (Gujarati

& Porter, 2009). Therefore, when irrelevant independent variables are

selected, they are correlated with error term, which will provide biased

results. Granger

(1969) developed granger causality test in order to determine causal

relationship between two variables and examine whether one time series data is

significant in forecasting another (Harasheh & Libdeh, 2011). The test aims

to examine whether the past values of a variable can be significant in

forecasting changes in another variable. Granger (1969) argued that granger

causality is a suitable test to determine the interaction between movements of

stock price and economic changes. The granger causality test is used to

determine the short run relationship between the dependent and independent variables.

The test provides two outcomes namely unidirectional and bidirectional

causality between variables. Multiple Regression

Analysis: Regressions

model is a method of analyzing data to examine the link between dependent and

independent variables. Therefore, in order to determine the relationship

between the macroeconomic variables and stock market performance, OLS

regression model will be applied. The functional method of this model would be

below.

Analysis and Interpretation of Findings

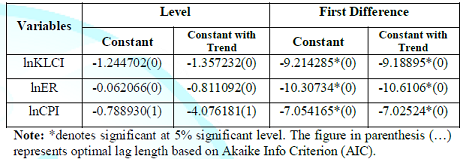

We

tested the existence of unit root by conducting both ADF and PP tests. After

ensuring that all the data is stationary we analyzed the presence of heteroskedasticity problem in the

model and then conducted the granger causality as well as the OLS regression

tests to find short-run and long-run relationship between macroeconomic

variables and the stock market performance in Malaysia respectively. The

results of the ADF and PP tests conducted in order to check the stationarity of

the time series data is shown in the table 1 and 2 respectively. The

ADF test shows that all the three variables namely exchange rate, KLCI and CPI are

non-stationary at level. However, after performing the first difference

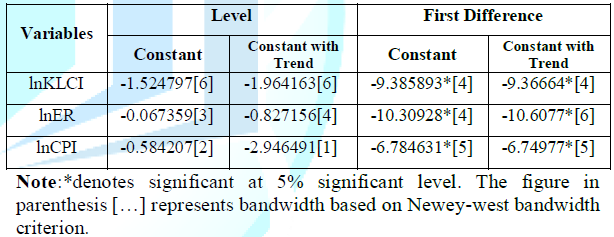

transformation, all the variables become stationary. The

results of PP test are in line with ADF test results. All the three variables

are non-stationary at level, but they all become stationary after the first

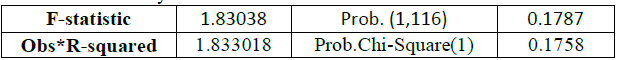

difference. Heteroskedasticity

Test

The

table 3 shows the results of the heteroskedasticity test. The decision rule

suggests that we accept Model

specification

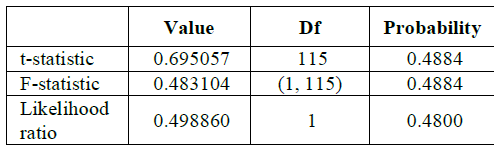

The

table 4 provides the results of the model specification test, which is obtained

by conducting

the Ramsey RESET test. The decision rule suggests that if P-value of

F-statistic is more than the significance level 5%, the model is correctly

specified. Granger

causality test is conducted in order to determine the causal relationship

between the independent variables and the KLCI. According to Ali (2014) if the

causal relationship between variables exists, they can be used to forecasting changes of

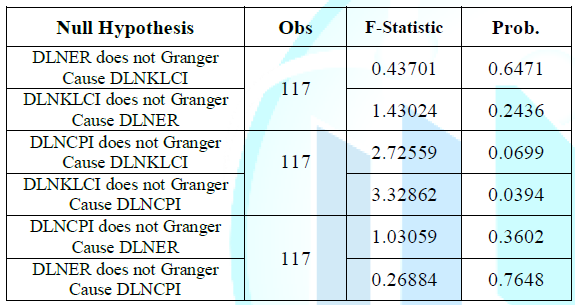

each other. The table 5 shows the results of the granger causality test. The

hypotheses for this test would be: Thus,

if P - value is less than the significant level 5%, we reject OLS

Regression Model

The

regression model is used in this research to determine the relationship between

stock market performance and the selected macroeconomic variables in Malaysia.

The hypotheses for the t-test would be: The

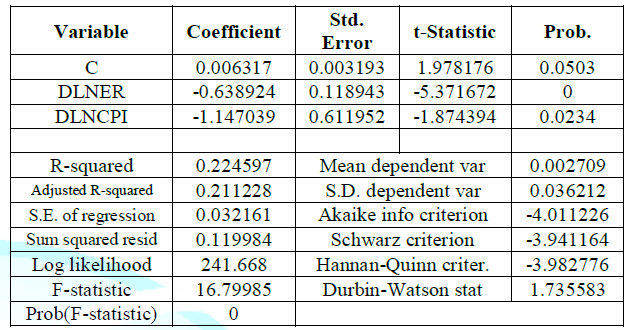

table 6 illustrates the results of the relationship between Malaysia stock

market returns and the two selected macroeconomic variables. Based on the above

results, the R-squared (0.224597) is relatively low, which implies a low

forecasting power of the multivariate model, and thus, there is a high

likelihood of the exclusion of relevant macroeconomic variables which may

significantly affect the variation of stock market performance in Malaysia.

Thus, based on R-squared, exchange rate and inflation are only accountable for

22.46% of the total variation of Malaysian stock market performance, which

suggests that 77.54% variation in the stock market performance in Malaysia is

influenced by other variables. The F-statistic value (0.000000) is also very

small, which implies that the selected macroeconomic variables jointly do not

have a significant impact on Malaysia stock market performance.

Dependent Variable: DLNKLCI

Furthermore, results suggest that in the long run, inflation is found to have a

negative relationship with the stock market performance in Malaysia. This

result is further supported by various previous literatures that found a

negative relationship between the stock market returns and inflation such as

Phuyal (2016), DeFina (1991), Humpe & Macmillan (2007), and Qamri et al.

(2015). DeFina (1991) has argued that an increase in the inflation negatively affect

the corporate income since it causes an immediate rise of cost, and slowly

reducing output and consequently the share price. Therefore, maintain a stable

level of inflation in the country will hugely contribute to a growing stock

market by increasing the number of foreign as well as local capital inflows. Stock market has become crucial

in promoting capital formation and sustaining economic growth in a country.

Therefore, understanding the movement of the stock market performance is very

important aspect, especially for developing countries like Malaysia in which

the stock market is relatively new compared to other more developed countries. This

study has empirically investigated the relationship between two selected

macroeconomic variables namely exchange rate and inflation, and the stock

market performance in Malaysia using both granger causality test and OLS

regression model. In order to test the stationarity of the data, ADF and PP

tests were conducted. Both ADF and PP tests have shown that the data is

non-stationary at level, and stationary at firs difference for all the three

variables. Ramsey RESET test also showed that the model is correctly specified,

which suggests that all the independent variables are important in explaining

the variation of the KLCI. Granger

causality test was conducted to establish the unidirectional and/or

bidirectional relationship between the dependent and independent variables. On

the basis of granger causality test, exchange rate and inflation do not granger

cause KLCI. This means that in the short run, these macroeconomic variables do

not affect the performance of the Malaysian stock market. However, results show

that there is a unidirectional causal relationship from KLCI to inflation. This

result suggests that past values of KLCI could be used to predict future

inflation level in the country. In

regard to OLS regression model, results suggest that exchange rate and

inflation have a negative effect towards the stock market performance in

Malaysia. Moreover, exchange rate and inflation are found to have a significant

influence in the variation of Malaysian stock market, in spite of the low

forecasting level indicated by R-squared. 1. Adusel

M. The Inflation-Stock Market Returns Nexus: Evidence from the Ghana Stock

Exchange (2014) J Economics Int

Finance 6: 38-46. DOI: 10.5897/JEIF2013.0556 2. Agrawal

G, Kumar Srivastav A and Srivastava A. A Study of Exchange Rates Movement and

Stock Market Volatility (2010) Int J

Business Management 5: 62-63. https://doi.org/10.5539/ijbm.v5n12p62 3. Ahmed

SF, Islam KMZ and Khan MR. Relationship between Inflation and Stock Market

Returns: Evidence from Bangladesh (2015) Daffodil Int Uni J Business Economics

9: 1-12. http://dx.doi.org/10.5296/ijafr.v4i2.6671 4. Ali

I. Impact of Foreign Direct Investment on Volatility of Stock Market: An

Evidence from Pakistani Market (2014) IOSR

J Business Management 16: 77-80. DOI: 10.1080/1331677X.2013.11517588 5. Barakat

M, Elgazzar S and Hanafy K. Impact of Macroeconomic Variables on Stock Markets:

Evidence from Emerging Markets (2015) Int J Economics Finance 8: 195. https://doi.org/10.5539/ijef.v8n1p195 6. Bello Z. The Association between Exchange Rates

and Stock Returns (2013) Investment

Management Financial Innovations 10: 109. 7.

Cakan

E and Ejara D. On the Relationship between Exchange Rates and Stock Prices:

Evidence from Emerging Markets (2013) Int Res J Finance Economics 1: 115-124. 8.

Chong

F and Puah CH. The Malaysian IPO Market: Volume, Initial Returns and Economic

Conditions (2009) 1-11. 9.

DeFina RH. Does Inflation Depress the Stock Market?

(1991) Federal Reserve Bank of Philadelphia Business Review 3-12. 10. Fama

EF. Efficient Capital Markets: A Review of Theory and Empirical Work (1969) J Finance

25: 383-417. DOI: 10.2307/2325486 11.

Fang WS and Miller SM. Currency Depreciation and Korean Stock

Market Performance during the Asian Financial Crisis. Working Paper,

University of Connecticut (2002). 12.

Fisher I. The Theory of Interest.

Macmillan, New York (1930). 13.

Geetha

C. Mohidin R. Chandran VV and Chong V. The Relationship between Inflation and

Stock Market: Evidence from Malaysia, United States and China (2011) Int J

Economics and Management Sciences 1: 1-16. 14.

Granger

CW. Investigating causal relations by econometric models and cross-spectral

methods (1969) J Econometric Society 424-438. 15.

Gujarati

DN, Porter DC. Basic econometrics. McGraw-Hill (2009). 16.

Gupta

R and Inglesi-Lotz R. Macro Shocks and Real US Stock Prices with Special Focus

on the "Great Recession" (2012) Appl Econometrics Int Development 12:

123-136. 17.

Harasheh

M and Abu-Libdeh H. Testing for Correlation and Causality Relationship between

Stock Prices and Macroeconomic Variables: The Case of Palestine Securities

Exchange (2011) Int Review Business Res Papers 7: 141-154. 18.

Humpe A and Macmillan

PD. Can Macroeconomic Variables

Explain Long-Term Stock Market Movements? A Comparison of the US and

Japan (2007) Working series paper. Centre for Research into Industry,

Enterprise, Finance and the Firm. 19. Khan Z, Khan S, Rukh L and Rehman WU. Impact of

Interest Rate, Exchange Rate and Inflation on Stock Market Returns of KSE 100

Index (2016) Int J Economic Res 3:

9-12. 20. Kutty

G. The Relationship between Exchange Rates and Stock Prices: The Case of Mexico

(2010) North American J Finance Banking Res 4: 1-12. 21. Lim

C and Sek S. Comparing the Performances of GARCH-type Models in Capturing the

Stock Market Volatility in Malaysia (2013) Procedia Economics and Finance 5: 478-487. https://doi.org/10.1016/S2212-5671(13)00056-7 22.

Long JS and Laurie HE.

Correcting for Heteroscedasticity with Heteroscedasticity Consistent Standard

Errors in the Linear Regression Model (1998). 23. Milambo

C, Maredza A and Sibanda K. Effects of Exchange Rate Volatility on the Stock

Market: A Case Study of South Africa (2013) Mediterranean J Social Sciences 4: 562. http://dx.doi.org/10.5901/mjss.2013.v4n14p561 24.

Mousa

SN, Al-safi W, Hasoneh A and Abo-orabi MM. The Relationship between Inflation

and Stock Price: A Case from Jordan (2012) IJAARS 10: 46-52. 25. Nordin

S and Nordin N. The Impact of Capital Market on Economic Growth: A Malaysian

Outlook (2016) Int J Economics Financial Issues 6: 259-265. 26.

Olweny

TO and Kimani D. Stock Market Performance and Economic Growth: Empirical

Evidence from Kenya using Causality Test Approach (2011) Advances Management

Appl Economic 1: 153-196. 27. Phuyal N. Can Macroeconomic Variables Explain

Long Term Stock Market Movements? A Study of Nepali Capital Market (2016) J Business Management Res 1: 87-89. https://doi.org/10.3126/jbmr.v1i1.14549 28. Qamri GM, Haq MAU and Akram F. The Impact of

Inflation on Stock Prices: Evidence from Pakistan (2015) Microeconomics and Macroeconomics 3:

67. DOI: 10.5923/j.m2economics.20150304.01 29. Soenen LC and Hennigar ES. An Analysis of

Exchange Rates and Stock Prices: The US Experience between 1980 and 1986 (1988)

Akron Business and Economic Review

Winter 19: 32-44. 30. Uwubanmwen

AL and Eghosa I. Inflation Rate and Stock Returns: Evidence from the Nigerian

Stock Market (2015) Int J Business

Social Sci 6: 155-165. 31. White

H. A Heteroskedasticity-Consistent Covariance Matrix Estimator and a Direct

Test for Heteroskedasticity (1980) The Econometric Society 48: 817-838. DOI:

10.2307/1912934 32. Wongbampo

P and Sharma SC. Stock Market and Macroeconomic Fundamental Dynamic

Interactions: ASEAN-5 Countries (2002) J Asian Economics 13: 27-51. https://doi.org/10.1016/S1049-0078(01)00111-7 33.

Yau H and Nieh C. Testing for Cointegration with Threshold

Effect between Stock Prices and Exchange Rates in Japan and Taiwan

(2009) Japan and the World Economy. https://doi.org/10.1016/j.japwor.2008.09.001 34. Younas

ZI, Farooq U and Nasir A. Exchange rate and stock market volatility: A case of

Pakistan (2013) J Business Administration Management Sci Res 2: 187-190.The Impact of Macroeconomic Variables on Stock Market Performance: A Case of Malaysia

Dercio Fernando Filipe Chauque, Patricia AP Rayappan

Full-Text

Introduction

Data

Unit

Root Test

Table 1: ADF Test Results.

Table 2: PP Test Results.![]() (no heteroskedasticity problem) if the

P-value

of the Chi-squared

is greater than the significance level 5%.

(no heteroskedasticity problem) if the

P-value

of the Chi-squared

is greater than the significance level 5%.

Heteroskedasticity Test: ARCH

Table 3: Heteroskedasticity Test Results.

Table 4: Ramsey RESET Test Results.

Based on the P-value of

F-statistic obtained (0.4884) which is greater than the significance level 5%,

we can conclude that the model is correctly specified.

Granger

Causality Test

![]() : X does not granger cause Y.

: X does not granger cause Y.![]() : X does granger cause Y.

: X does granger cause Y.![]() and consequently accepting

and consequently accepting ![]()

Table 5: Granger Causality Test Results.

From

the results presented above, it can clearly be seen that exchange rate and

inflation do not influence in the performance of KLCI in the short run, since

all P-values are above 5%. However, the same results suggest that in the

short-run, the performance of the stock market in Malaysia granger cause inflation.

Method: Least Squares

Date: 11/29/17 Time: 00:41

Sample (adjusted): 2007M02

2016M12

Included observations: 119 after

adjustments

Table 6: OLS Regression Results.

The

t- test of OLS regression model indicates that both exchange rate and inflation

rate have a significant impact on the Malaysian stock market performance.

Moreover, in the long run there is a significant negative relationship between

the exchange rate and KLCI. This result is in line with previous research

conducted by Bello (2013), Fang & Miller (2002), Khan et al. (2012), Ouma

& Muriu (2014) and Jawaid & Haq (2012). Fang & Miller (2002) have

argued that the depreciation on the domestic currency increases the returns on

dollar assets. Therefore, investors tend to shift their funds from the domestic

assets such as stocks to dollar based assets for higher expected returns. This

shift in portfolio composition favors dollar assets over domestic stocks, leading

to a decline in the stock market prices and thus its returns as well. However,

findings from this study are not supported by other studies like Cakan &

Ejara (2013), Soenen & Hennigar (1998), Chiang, and Yau & Nieh, (2009)

who found a positive relationship between the exchange rate and stock market

returns.Conclusion

References