Introduction

Stock market efficiency is an

essential property of the market. The classic paradigm of Efficient Market

Hypothesis (EMH) was widely accepted since the early 1970’s and is based on three

essential pillars such as investor rationality, uncorrelated errors, and the

assumption that there are no limits to arbitrage. According to [1] the ideal

financial market would be guided by the principle that prices provide accurate

signals for resource allocation. It implies that rational, profit-maximizing

investors are not able to consistently outperform the market since prices of

stocks in the market are fair, that is, there are no undervalued stocks in the

market. Price shocks also are an integral part of the stock market. The flow of

news is continuous and practically infinite, and from time to time some of them

may be very influential for a given stock, a group of stocks or the stock

market in general, and lead to large stock price changes, representing both a

serious risk and a great opportunity for stock market investors.

A vast strand of financial

literature deals with large one-day stock price changes and their consequences.

The major research question of these studies is: What are the patterns of stock

returns following index market changes and can we predict these returns to

build a profitable investment strategy? The answers to this question vary as a

function of the samples analyzed by the authors and the research approaches

applied by them. A few studies [2-5] document price reversals following initial

price moves, and therefore, suggest that the latter contain some element of

overreaction. Another cohort of studies either does not detect any significant

price patterns following major price changes [6,7] or finds some evidence of

reversals, but concludes that they are relatively small and cannot be

practically used for generating

profitable investment opportunities

[8-10]. The third influential group of studies [11-14] suggests that large

stock price moves should be analyzed in a wider company-specific context, and concentrates

on the role of public information in determining subsequent price patterns. The

general conclusion arising from this literature is that stock price moves

accompanied by public information releases result in price drifts, indicating

that investors tend to underreact to news about fundamentals, while those that

are not accompanied by any public news are followed by reversals, suggesting

that investors tend to overreact to other shocks that move stock prices, such

as shifts in investor sentiment or liquidity shocks.

The holiday effect is one of the

most widely analyzed calendar anomalies in stock markets. Its best-known aspect

refers to the observed fact that stock returns typically exhibit consistent

patterns around holidays, with systematically higher returns on days prior to

major holidays. The holiday effect is well-documented both in the US [15-17]

and worldwide [18-21] stock markets. The dominating explanation for the

existence of the holiday effect lies in investor psychology [17,22] suggesting

that investors tend to buy stocks before holidays because of ‘high spirits’ and

‘holiday euphoria’ [23,24] which cause them to

expect positive returns in the sequel. In recent empirical studies on calendar

anomalies or seasonal anomalies revealed that some of the calendar anomalies

like day of the week effect [25] month of the year effect and turn of the month

effect seem to have weakened or disappeared over the sample time period. To

test the existence of the holiday effect in the Vietnamese stock market, the

study is based on the daily return rate data sample of the VN-Index from March

1st, 2002. The period before Lunar New Year is defined as 5 trading

days before the market closes for Lunar New Year holiday. Similarly, the period

after the Lunar New Year is defined as 5 trading days after the Lunar New Year

holiday when the stock market is active again. The difference in the return on

indices in the period around the Lunar New Year compared to the rest of the

trading days is the basis for testing the existence of the Lunar New Year

effect on the Vietnamese stock market. This study uses the following

quantitative data analysis methods: basic descriptive statistical method,

Generalized Autoregressive Conditional Heteroskedasticity (GARCH).

Literature Review

The holiday effect is one of the

seasonal phenomena and this phenomenon presents a contradiction with the

efficient market theory an important financial hypothesis. Seasonal phenomena

can be understood as seasonal effects that produce either higher or lower

returns depending on the nature of the time series. These effects are also

known as market anomalies because these anomalies cannot be explained by

traditional asset pricing models. Examples of some popular effects such as

January Effect, Day-of-the week Effect, Turn of the month Effect, holiday

effect.

The holiday effect was first

identified by [26] since then there has been much debate about the effect of

the holiday. [27,15] show in their in-depth studies that pre-holiday returns

are higher than post-holiday returns. Unusual returns were found not only over

the weekend but for any given moment of trading. Lakonishok and Smidt even

pointed out that the holiday effect accounted for about 30-50% of the total

return on the US market in the early 1987. Ariel showed that pre-holiday

returns were eight times higher than post-holiday returns. He found that 8

public holidays per year accounted for 38% of total annual return rate. [16,17]

also found that the US holiday affected market indices from the New York Stock

Exchange, AMEX and NASDAQ from 1963-1987 and 1987-1993. Many other scholars

have also analyzed, have taken a closer look at stock returns both before and

after each holiday. Their research has shown differences in holidays in

countries other than the US (Canada, Japan, Hong Kong and Australia [28] Turkey

[29,30].

Cadsby and Ratner have studied the

holiday effect in international markets [28]. They observed Canadian, Japanese,

Hong Kong and Australian markets from 1962 to 1989 and examined local holidays

and market indicators from each country. The results point to a significant

pre-holiday effect in all observed markets, with highest returns occurring in

the days before the holiday. Kim and Park provided further evidence of the

holiday effect in research on the Nikkei (Japan) and the Financial Times (UK),

confirming the results of Cadsby and Ratner for the Japanese market.

Subsequently, [16] also noted an effect of the size of firms in these markets [18]. Examined the validity of vacation in 17 markets in

different countries. Their results show a clear 65% effect at the pre-holiday

in the observed samples. Studies in Southeast Asia [31,28,32,33,34] have

identified the presence of a New Year effect in China. [33] find evidence that

stock yields of post-holiday are significantly higher than pre-holiday in Hong

Kong, Japan, Malaysia, Singapore, Korea and Taiwan. [31] determined that both Chinese New Year and Ramadan's holiday had an

impact on the Kuala Lumpur stock market; [34] confirmed

the impact of the Chinese New Year on Thailand, Singapore and Malaysia markets

along with the Hindu holiday effect in Singapore and Malaysia.

Worthington [19] examined the

holiday effect in the Australian market and concluded that the holiday effect

is limited to small firms. He used 12 different stock indices in the Australian

stock exchange over a 10-year period (1996-2006) providing 2,635 observations

on the Australian Stock Exchange (ASX). His experiments showed that the holiday

effect in market representation indices with stock returns before vacation is

often 5 times higher than on other normal days. His research shows that the

performance of small-cap companies before the holiday, and for small-value

stocks, returns 10 times higher than on other trading days. The main

explanations of the holiday phenomenon are explained in detail according to the

following hypotheses of the efficient market theory. Firstly, it can be

explained by the investment psychology. Arguably the most promising explanation

for the holiday effect lies in investor sentiment [17,22]. The theory shows

that investors tend to buy stocks before the holiday because of “being in good

shape” and “holiday excitement”. Secondly, it can be explained by the end of

the transaction. One possible explanation is that high pre-holiday returns are

an expression of good closing prices, where high returns on stocks are observed

at the closing market. One research team linked pre-vacation activity to the

system models in the data set used to calculate pre-holiday returns. On the

behavior side, the explanations include from short-term sellers who end up risk

before the holiday, with psychological reasons such as investors' good

sentiment around vacations showing more optimism about the future.

Data’s and Research Methodology

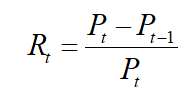

To test the existence of the Lunar New Year effect in the Vietnamese stock market, this study has collected the data of the VN-Index from March 1st, 2002 to the end of 2018. The research chose the starting time of the data set is 2002 because the first 2 years (from 28/7/2000 the liquidity of the Vietnamese market is still low, there are only 3 transaction per week and the value of the transaction is low). The VN-Index daily closing price data was collected from March 1st, 2002 to December 31st, 2018, for a total of 4190 observations from the Ho Chi Minh City Stock Exchange. The VN-Index daily data is used to calculate the daily rate of return by using the following formula:

Including

Rt is stock return from day t-1 to

day t

Pt is closing price at

day t

Pt-1 is closing price at

day t-1

This study stipulates that the

period before the Lunar New Year is 5 trading days before, and the period after

the Lunar New Year is 5 trading days after. Since the Lunar New Year will take

place according to the repetitive rule of late January, early February, and

late February, if a longer observation range such as 15 days is used, it may be

affected by the January Effect. This study will apply the GARCH model (1,1) and

its extended models, and consider these models under the student-t

distribution. Similar models are applied by many previous studies such as that

of [15,26,34]. The GARCH (1,1) model will be developed to estimate the

coefficients of the variables and evaluate the significance of each

coefficient.

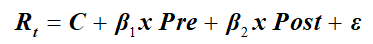

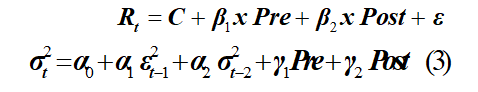

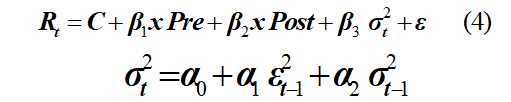

The model GARCH (1,1) in this study has the following equation

Expected equation

Including

Rt is the rate of return of the VN-Index

C is a constant, equal to the rate

of return on regular trading days

Pre is a dummy variable that takes

value of 1 for the period of 5 business days before the Lunar New Year holiday

and 0 for the remaining trading days.

Post is a dummy variable that takes

value of 1 for the period of 5 business days after the Lunar New Year holiday

and zero value for the rest of the trading days.

ε is the error (remainder) of the

regression model.

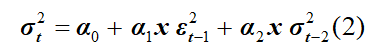

Variance equation

Including

α0 is a constant

Ɛ2t-1 Gives information about the

previous time fluctuation determined by squaring the error (remainder) from the

expected equation. (ARCH term)

σ2t-2 is the predictive variance in

the previous period (GARCH term)

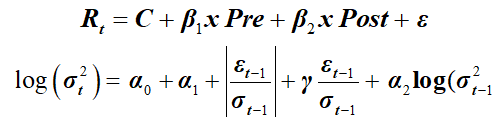

The Modified-GARCH (1,1) modified GARCH model adds the

impact of the pre- and post-Lunar New Year periods to the variance equation by

adding dummy variables Pre and Post. The Modified-GARCH (1,1) model looks like

this:

Next, to observe the relationship between the return and the respective risk, the variance σ2t-2 is added to the right side of the expected equation (1). The GARCH-M model looks like this

Another popular extended model of the GARCH model proposed by Nelson (1991) is the Exponential General Autoregressive Conditional Heteroskedastic (EGARCH) or EGARCH (EGARCH) model. The EGARCH model has the following equation

As can be seen, since log (σ2t-2)

can be negative while log (σ2t) is always positive, the

EGARCH model removes the constraints of the usual GARCH model parameters. The

study will use EViews software to apply GARCH, Modified-GARCH, GARCH-M and

EGARCH models in turn to test the existence of the Lunar New Year effect on the

stock return. After that the research compares the Akaike Info Criterion (AIC)

and Schwarz Criterion (SC) to find the most suitable model.

Empirical Result

Table 1 and Table 2 report the basic descriptive statistical results and the estimated results of the stock return as well as the periods around the Lunar New Year.

Table 1: Descriptive statistic of stock return.

Firstly, the study classified 4190

daily return of VN-Index into periods before Lunar New Year, after Lunar New

Year and other trading days. During the period before Lunar New Year and after

Lunar New Year, there are 80 observations, a total of 160 observations around

the Lunar New Year, the remaining 4030 observations of the remaining trading

days. From Table 1, the VN-Index's average daily return is 0.03680 with a

standard deviation of 1.40513 while the average return on trading days outside

the Lunar New Year period is low, it is 0.02556.

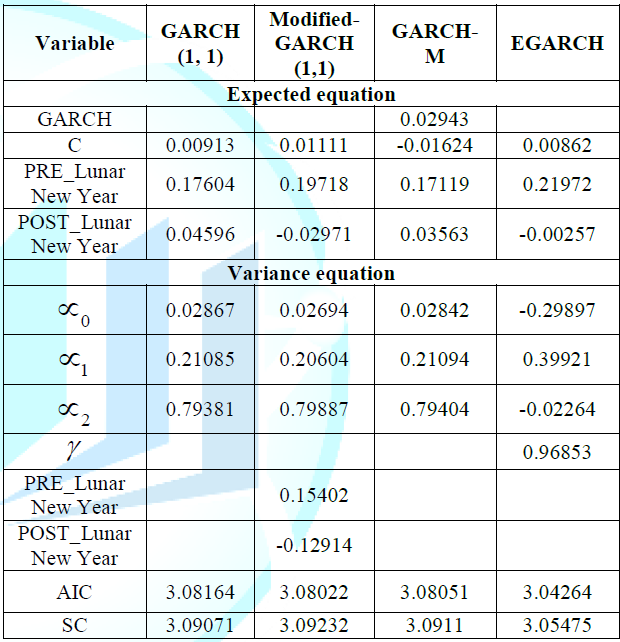

Table 2: Result of ARCH estimation.

The average daily stock return of

the 5-day period before the Lunar New Year is 0.45555, many times higher than

that of the whole VN-Index and with normal trading days. However, the deviation

of the post- Lunar New Year return rate is higher than the average for the

whole index, meaning that the risk of the post-Lunar New Year period is higher

than the average. In addition, the Lunar New Year period also brings a higher

than normal rate of return but does not come with a higher level of risk. From

there, the existence of a positive effect of the Lunar New Year period on the VN-Index

is completely grounded.

In general, through analyzing the

preliminary statistical statistics, it can initially be seen that the existence

of the Lunar New Year effect on the VN-Index is quite clear, especially in the

period before Lunar New Year. Up to this step, some previous studies such as by

Mills and Coutts (1995) have concluded the existence of a holiday effect in the

UK stock market from 1986 to 1992. However, this is also the limitation of

these studies because it will be the lack of conclusion when the stock return

data source indicators do not follow the normal distribution.

This shows that if only based on the

average return, standard deviation to conclude the existence of the Lunar New

Year effect on the VN-Index will be a major omission.

Models GARCH (1,1), adjusted GARCH (1,1),

GARCH-M and EGARCH were applied to estimate the coefficients of the rate of

return in the period before and after the Lunar New Year. Table 2 presents the

regression results on the Lunar New Year effect and the volatility of stock

returns from March 1, 2002 to December 31, 2018. To find the optimal model

among the above 4 models, we use the Akaike info criterion (AIC) and the Schwarz

Criterion (SC). These indicators are in which model the smallest value gives

the best model. We see, EGARCH model has the lowest AIC and SIC indices, so

this model is more optimal than the other models. Estimated results by EGARCH

model, the trading days outside the Lunar New Year period give a low profit

margin of 0.21972 and the positive effect of the period before the Lunar New

Year exists at 5% significance level.

The stock return after Lunar New

Year holiday was lower than other days, but it was not statistically

significant at 5%. The equation of variance with the addition of an asymmetric

coefficient value less than 0 indicates that positive effects (good news) will

cause lower volatility than negative effects (bad news). At the same time, there

is no sign of leverage effect on the VN-Index. However, the coefficient is not

statistically significant. Through the EGARCH model, this study noted the

positive influence of the period before the Lunar New Year, in other words the

existence of the Lunar New Year effect on the VN-Index.

Conclusions

Based on previous studies related to

the calendar effect, especially the holiday effect, this study examines the

existence of the Lunar New Year effect on the Vietnamese stock market through

VN-Index data from March 1, 2002 to December 31, 2018. Simple descriptive

statistics show that the stock return in the period before and after the Lunar

New Year is higher than the average of the remaining trading days. However, the

impact index of the period before Lunar New Year is statistically significant. Regression

model according to the ARCH is applied in this study.

The OLS method is the simplest and

is also widely used in previous experimental studies, but the conclusion is

inconsistent because of the existence of cointegration and variable variance of

the data series. The GARCH (1,1) model allows variance to change over time. The

Modified-GARCH (1,1) model adds the impact of periods before and after the

Lunar New Year to the equation of variance. The GARCH-M model adds a risk

factor to the regression equation. The EGARCH model removes the constraint of

parameters in conventional GARCH models. Although the above models all have

their own advantages and the regression results are quite similar, the research

selected EGARCH model as the most optimal model to publish conclusions.

Regression results from the EGARCH

model recognized the existence of a positive impact of the period before the

Lunar New Year on the stock return of the VN-Index. The results of this study

present clear evidence of the existence of the Lunar New Year effect on the

Vietnamese stock market. The emergence of a seasonal phenomenon (holiday

effect) on the Ho Chi Minh City Stock Exchange has proven ineffective in the

market, the most obvious manifestation of which is the existence of the period

around the Lunar New Year.

The stock return increased many

times compared to the average of normal trading days but not accompanied by an

increase in risk made it difficult for investors to sit still and watch.

Investors can refer to the results of this study to determine their investment

duration. Investors can take advantage of the Lunar New Year effect, buy stocks

in corrective sessions before the Lunar New Year and hold until the period

before Lunar New Year to sell when the market rallies. Short-term investors can

fully apply the strategy of buying in in the correction sessions before the

Lunar New Year and selling in the last trading session before Lunar New Year

holiday. However, investors should note that if all investors apply similar investment

tactics to take advantage of the Lunar New Year effect, this effect will

disappear and disable the above investment strategies.

Acknowledgment

Pham Dan Khanh would like to acknowledge the support of the National Economics University. This research paper is resulted of the research project at university level code KTQD/V2020.42 of the National Economics University.

Reference

1. Fama E. Efficient Capital Markets: a review of theory and empirical work (1970) The J Finance 25: 383-417. https://doi.org/10.2307/2325486

2. Zarowin P. Short-Run Overreaction: Size and Seasonality Effects (1989) J Portfolio Management 15: 26-29. https://doi.org/10.3905/jpm.1989.409209

3. Marc B and Sweeney JR. The Reversal of Large StockPrice Decreases (1991) J Finance 46: 747-754. https://doi.org/10.1111/j.1540-6261.1991.tb02684.x

4. Cooper M. Filter rules based on price and volume in individual security overreaction (1999) Review of Financial Studies 12: 901-935. https://doi.org/10.1093/rfs/12.4.901

5. Sturm RR. Investor confidence and returns following large one-day price changes (2003) The Journal of Behavioral Finance 4: 201-216. https://doi.org/10.1207/s15427579jpfm0404_3

6. Lasfer MA, Melnik A and Thomas D. Stock Price reaction in Stressful Circumstances: An International Comparison (2003) J Banking and Finance 27: 1959-1977. https://doi.org/10.1016/s0378-4266(02)00313-8

7. Mazouz K, Nathan LJ and Joulmer J. Stock price reaction following large one-day price changes: UK evidence (2009) J Banking and Finance 33: 1481-1493. https://doi.org/10.1016/j.jbankfin.2009.02.010

8. Atkins AB and Dyl EA. Price reversals, Bid-Ask Spreads and Market Efficiency (1990) J Financial and Quantitative Analysis, 25: 535-547. https://doi.org/10.2307/2331015

9. Park J. A Market Microstructure Explaining for Predictable Variations in Stock returns following large Price Changes (1995) J Financial and Quantitative Analysis 30: 241-256. https://doi.org/10.2307/2331119

10. Fehle F and Zdorovtsov V. Large Price Declines, news, liquidity and Trading Strategies: An Intraday Analysis (2003) University of South Carolina Working Paper. https://doi.org/10.2139/ssrn.298092

11. Pritamani M and Singal V. Return Predictability following large Price Changes and Information releases (2001) J Banking and Finance 25: 631-656. https://doi.org/10.1016/s0378-4266(00)00091-1

12. Chan WS. Stock Price reaction to news and no-news: Drift and reversal after headlines (2003) J Financial Economics 70: 223-260. https://doi.org/10.1016/s0304-405x(03)00146-6

13. Tetlock PC. Does Public financial news resolve Asymmetric Information? (2010) Review of Financial Studies 23: 3520-3557. https://doi.org/10.1093/rfs/hhq052

14. Savor P. Stock returns after Major Price Shocks: The Impact of Information (2012) J Financial Economics, 106: 635-659. https://doi.org/10.1016/j.jfineco.2012.06.011

15. Lakonishok J and Smidt S. Are Seasonal Anomalies Real? A Ninety-Year Perspective (1988) Review of Financial Studies 4: 403-425. https://doi.org/10.1093/rfs/1.4.403

16. Kim CW and Park J. Holiday Effects and Stock Returns: Further Evidence (1994) J Financial Quantitative Analysis 29: 145-157. https://doi.org/10.2307/2331196

17. Brockman P and Michayluk D. The persistent holiday effect: Additional evidence (1998) Taylor and Francis J 5: 205-209. http://doi.org/10.1080/135048598354825

18. Agrawal A and Tandon K. Anomalies or illusions? Evidence from stock markets in eighteen countries (1994) J Int Money Finance 13: 83-106. https://doi.org/10.1016/0261-5606(94)90026-4

19. Marrett GJ and Worthington AC. An empirical note on the holiday effect in the Australian stock market, 1996-2006 (2008) Appli Economics Letters 16: 1769-1772. https://doi.org/10.1080/13504850701675474

20. Bley J and Saad M. Cross cultural differences in seasonality (2010) Int Review of Financial Analysis 19: 306-312. https://doi.org/10.1016/j.irfa.2010.08.004

21. Dodd O and Gakhovich A. The holiday effect in central and eastern european financial markets (2011) Investment Management and Financial Innovations 8: 29-35.

22. Vergin RC and McGinnis J. Revisiting the Holiday Effect: Is it on Holiday? (1999) Appli Financial Economics 9: 477-482. https://doi.org/10.1080/096031099332131

23. Frieder L and Subrahmanyam A. Nonsecular regularities in returns and volume (2004) Financial Analysts Journal 60: 29-34. https://doi.org/10.2469/faj.v60.n4.2634

24. Bergsma K and Jiang D. Cultural New Year Holidays and Stock Returns around the World (2016) Financial Management Association Int 45: 3-35. https://doi.org/10.1111/fima.12094

25. Nhuong BH, Khanh PD and Dat PT. Calendar effects: Empirical evidence from the Vietnam stock markets (2020) Int J Advanced App Sci 7: 48-55. https://doi.org/10.21833/ijaas.2020.12.005

26. Fields MJ. Security prices and stock exchange holidays in relation to short Selling (1934) J Business 7: 328-338. https://doi.org/10.1086/232387

27. Ariel R. High stock returns before holidays: Existence and evidence on possible causes (1990) J Finance 45: 1611-1626. https://doi.org/10.1111/j.1540-6261.1990.tb03731.x

28. Cadsby BC and Ratner M. Turn-of-the-Month and Pre-Holiday effects in stock returns (1992) J Banking and Finance 16: 497-509. https://doi.org/10.1016/0378-4266(92)90041-W

29. Bildik R. Effects of Price Limits on Volatility: Evidence from the Istanbul Stock Exchange (2004) Emerging Markets Finance and Trade 40: 5-34. https://doi.org/10.1080/1540496x.2004.11052563

30. Bergsma K and Jiang D. Cultural New Year Holidays and Stock Returns around the World (2016) Financial Management Association Int 45: 3-35. https://doi.org/10.1111/fima.12094

31. Wong PL, Neoh SK, Lee KH and Thong TS. Seasonality in the Malaysian stock market (1990) Asia Pacific J Management 7: 43-62. https://doi.org/10.1080/096031099332131

32. Tong WHS. An analysis of the January effect of the united states, Taiwan and south Korean stock returns (1992) Asia Pacific J Management 9: 189-207. https://doi.org/10.1007/bf01732896

33. Yen H and Shyy AL. Chinese New Year effect in Asian Stock Markets (1993) Taiwan National University Management J 4: 417-436.

34. Chan MWL, Khanthavit A and Hugh T. Seasonality and Cultural Influences on Four Asian Stock Markets (1996) Asia Pacific J Management 13.

Corresponding author

Pham

Dan Khanh, School of Advanced Education Program, National Economics University,

207 Giai Phong Road, Ha Noi, Vietnam, Tel: 0948095169, E-mail: khanhpd@neu.edu.vn

Citation

Khanh DP, Thanh DP and Nhuong HB. A re-examination of the holiday effect in stock returns: the case of Vietnam (2020) Edelweiss Appli Sci Tech 4: 51-54.

Keywords

Calendar effects, Efficient market hypothesis, Dummy

variable regression, Holiday effect, VN-Index and Lunar New Year.

PDF

PDF